- Tuesday Thursday Saturday

- Posts

- 🏃♀️ Always Take the Meeting

🏃♀️ Always Take the Meeting

Why Worker Optionality is Replacing Company Loyalty — Plus, How Founder-Led Stocks Are Performing So Far in 2025

Welcome to Tuesday Thursday Saturday! I share a snapshot of trending stories across business, tech, and culture three times a week. Subscribe for more! - KP

The Big Story: It’s Not Disloyalty If It’s Survival

There’s a gentleman named Soham trending on X right now. Allegedly, he has made a habit of interviewing for and accepting overlapping remote engineering roles, phoning it in (if that), waiting until the company realizes he’s not really doing the work, and then moving on to the next job, all while collecting paychecks along the way. It’s chaotic, it’s controversial, and (I think) it’s a byproduct of the gnarliness of the modern job market.

Since this post was published, multiple founders have stepped forward and admitted to hiring Soham.

This isn’t a new phenomenon. Moonlighting, working more than one job at once, or having a side hustle while holding down a full-time gig, has existed for ages. But if the accusations are true, what Soham is doing isn’t moonlighting. It’s closer to scamming. He’s not adding value. He’s not even pretending to. He’s exploiting system gaps, and that’s very different from the kind of moonlighting I’m about to defend.

Because here’s my somewhat controversial take: I’m very pro-moonlighting.

In previous roles, I’ve had colleagues with multiple side hustles. Some didn’t quit their old jobs and were doing two at once. Two full-time jobs. At once! And as long as you’re delivering on your work and adding value? I genuinely don’t care. If anything, I think it’s astute.

The current work landscape makes moonlighting not just reasonable, but necessary. Massive layoffs across major companies in 2025 have underscored just how precarious full-time employment really is. Microsoft just announced a second round of cuts, laying off 9,000 employees across departments, including sales, gaming, and engineering. Just a month earlier, Procter & Gamble said it would be eliminating up to 7,000 jobs over the next two years. Intel is undergoing a restructuring that could impact over 10,000 positions, and Meta will reportedly lay off 5% of its workforce this year alone.

These are not small companies in trouble, these are dominant, profitable players making strategic cuts to protect their bottom line, often while investing heavily in automation and AI. Some of the best advice I got early in my career was, “You’re the only person waking up every day and looking out for you.” I think about this constantly.

With AI increasing productivity expectations, companies enforcing back-to-office mandates, and layoffs gutting teams only to redistribute more output to fewer people, the power dynamic has tipped sharply in favor of employers. Employees are expected to work through illness, sacrifice evenings and weekends, and fit their lives around work as if it’s the final stages of a Tetris game, especially in startup environments. All of this, often, for a little bit of equity that may or may not be worth anything in the end.

After the pandemic, workers with the luxury of having a ‘desk job’ began to take advantage of remote and hybrid work structures to level up. According to a recent report from ResumeBuilder, nearly 69% of remote workers admit to having more than one full-time job (although 34% of workers surveyed said they were self-employed). Another report from the Financial Times highlighted that approximately 4 million college graduates now hold more than one job, up from 2.4 million before the pandemic.

Is this an objectively bad thing, or is it bad in some cases? The ResumeBuilder report found that two-thirds of moonlighters “steal primary company’s time to work for others.” Not great. Still, 91% believed they were still meeting expectations at their primary job.

I’ve long been an advocate of side hustles, and I think it’s antiquated when an employer expects you to pledge full loyalty to them and proactively disclose other ways you may earn income outside of your salaried position. Lazy people will be lazy whether they are doing one job or seven. Hard workers with talent will provide value in most, if not all, environments you put them in. That’s just life.

So if someone decides to take on a second role, pick up freelance work, or test a business idea in their off-hours, I’m generally for it. To me, the idea that you have to disclose every side pursuit to your employer is outdated. If it doesn’t create a conflict of interest, doesn’t interfere with your primary role, and your output remains strong, why should it matter?

The expectation of exclusivity in exchange for employment is becoming less relevant, especially in white-collar sectors. Employers don’t guarantee job security. They don’t guarantee loyalty. So why should employees?

Something we don’t often talk about is how the moonlighter’s mindset isn’t just for junior or mid-level employees. Executives at many companies, while not officially "moonlighting," often have board seats, invest in startups, advise founders, or build their own ventures on the side. They leverage their network and resources, sometimes even EA support or company infrastructure, to manage both personal and professional pursuits. That’s just accepted.

So why is it different when someone lower on the org chart does the same? Why is it only admirable when the person who’s doing it has a big title and their own office?

I’ve held full-time roles and I’ve worked for myself, but regardless of my W2 status, I always think of myself as a business. Run your time and energy like assets. Protect your downside. Diversify your income. Stay open to acquisition (AKA a better job offer). Consider partnerships (collaborations, side gigs). Be strategic, just like your employer is.

As a business owner, you have a fiduciary responsibility to your shareholders, AKA you (and/or your family), to do what’s in the best interest of the business. That might not always align with the best interests of your current employer. And that’s just how it is.

Here’s the irony, though. People who run companies should get this more than anyone. At the end of the day, it’s unfair to ask someone to suppress their fiduciary responsibility to themselves and their future just to maintain the illusion of loyalty. As a business owner, they would never make that trade. Neither should you.

I want to be crystal clear that I am not defending laziness or deception. I don’t condone doing the bare minimum. I don’t endorse lying on resumes or half-assing work. I believe in being excellent at what you commit to. But I also don’t think excellence requires monogamy.

At the end of the day, it’s about output. That’s the metric that matters. Running a fractional marketing business, I work with several startups and companies at the same time. My scope approach always starts with the output: what do they need, and by when? I define the deliverables, calculate how long and how much effort it’s going to take me, and that becomes the cost. I don’t just charge a flat hourly rate, and I don’t charge a blanket retainer. I define the output, then map a price to it.

Does this make invoicing a pain for my business operations manager? Yes. Is it more complicated for me to track? Also yes. Does it sometimes result in leaving money on the table? Probably. But I believe you should be paid for the value of the work you’re doing, not the time you spend logged into Slack.

What Soham was (allegedly) doing was just collecting a paycheck for being on the books. No output, no value, just a paper trail. That’s not the same as someone juggling multiple gigs and still delivering at a high level. If you can piece together your life and career in a way that includes multiple income streams, and you're still performing? Good for you.

We’re shifting away from a philosophy of workplace loyalty and toward one of worker optionality. Loyalty isn’t the right framework anymore. Diversification is. Survival is. If you’re not sleeping with one eye open, if you’re not always open to a meeting, a gig, or a pivot, you could fall behind.

In corporate environments, there’s often this unspoken pressure to either align with management or align with the broader employee base. You can be a big boss or you can be a union boss, but you certainly cannot be both. But is this truly an “us versus them” scenario? Or, is it just a natural human evolution to shifting dynamics in the workplace?

I can sympathize with the POV of leadership in that, without policies in place, there will inevitably be abuse, waste, and potentially fraud. But consider the types of workers with the willpower and ambition to take on more than the bare minimum — are these really the types of talent you want to be alienating at the end of the day? Or, are they more like you than you care to admit?

Now Here’s a Chart

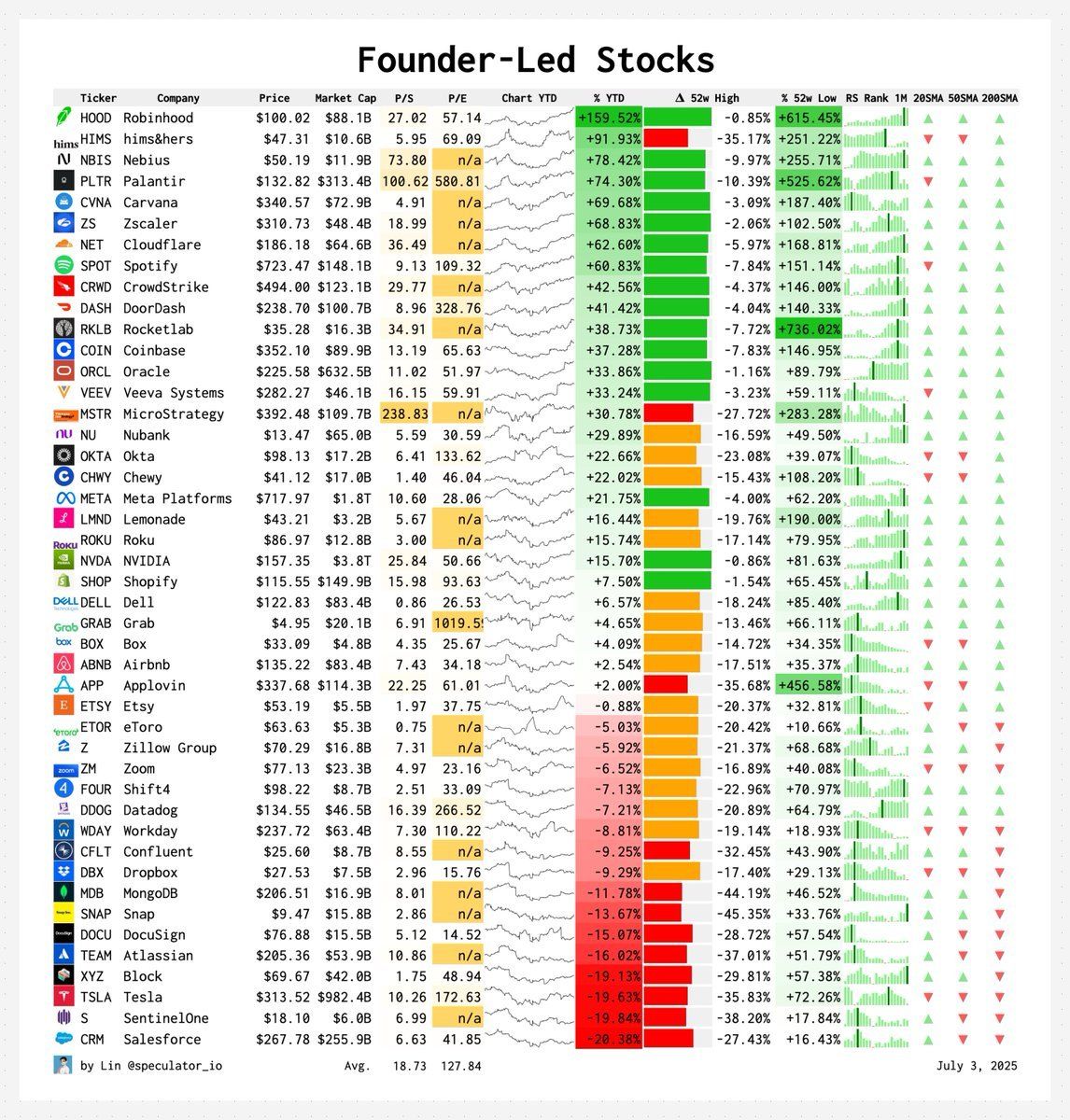

In the course of a company’s journey from inception to the public markets, it’s natural for founders to drop off or rotate out along the way. Still, there are many publicly-traded companies where the founders remain intact.

A great graphic from @speculator_io on X, looking at the performance of some of the more popular founder-led stocks year-to-date.

Daily Rip Live: Kalshi vs. Polymarket, Tracking Comeback Stocks, and What the Heck is Malik Beasley Thinking?

Every weekday, my co-host Shay Boloor and I cover the biggest market news and events LIVE on Stocktwits’ morning show, The Daily Rip Live. On yesterday’s show, we brought in two special guests: Tom Bruni, Editor-in-Chief at Stocktwits, and Ben Horney, Deals Reporter at Front Office Sports.

Here’s what we covered:

⇢ 0:57 The sales figures didn’t suck – Tesla finally snapped an eight-quarter streak of declining delivery growth, just barely. $TSLA ( ▲ 0.1% )

⇢ 5:33 Physical AI opportunity – Shay believes Elon Musk’s long-term vision for robotics and physical AI will ultimately transform Tesla’s valuation.

⇢ 10:50 Applovin and missed shots – Shay laments missing a 10-bagger on Applovin, while Tom explains why Robinhood continues to win with retail investors despite past backlash. $APP ( ▲ 1.88% ) $HOOD ( ▲ 0.59% )

⇢ 13:08 Short memories – The gang reflects on Robinhood’s reputation rebound. People don’t “give a good goddamn what happened last quarter” in this attention-deficit market.

⇢ 16:48 Prediction markets explained – Ben outlines why Kalshi can legally operate nationwide, thanks to regulation by the CFTC, unlike Polymarket. The rivals are both based in New York, and both just announced massive funding rounds.

⇢ 18:24 Tokenizing real-world assets – Shay predicts a future where everyday investors can own shares in athletes and teams through asset tokenization. We’re a long way off, but Robinhood and Republic’s latest moves signal what could come.

⇢ 43:39 Retail VC access – We discuss the challenges and appeal of retail investors accessing private companies like Anduril and Anthropic, and why the current model of purchasing shares on the secondary market is due for an upgrade.

⇢ 47:33 Volatility not slowing down – Tom doesn’t expect calmer markets in H2, warning that unresolved issues like tariffs and geopolitics still loom. Buckle up!

🙏 P.S. The Daily Rip Live show continues to net about 100K streams/week! Thanks to everyone for tuning in, and we will see you next week!

Reading List

U.S. payrolls increased by 147,000 in June, more than expected (CNBC)

The US dollar is on track for its worst year in modern history (Semafor)

Cloudflare Is Blocking AI Crawlers by Default (Wired) $NET ( ▲ 0.63% )

OpenAI condemns Robinhood’s ‘OpenAI tokens’ (TechCrunch) $HOOD ( ▲ 0.59% )

Datadog is joining the S&P 500 (Fast Company) $DDOG ( ▼ 0.97% )

AI voice startup ElevenLabs pushes global expansion as it gears up for an IPO (CNBC)

New York Private Surf Club Wants to Raise $45M, Charge $100K (Front Office Sports)

Cashmere Fund’s strategy to lure retail investors: celebrities (Pitchbook) *Client

Now Playing: “In a Broken Dream” - Rod Stewart

Tuesday Thursday Saturday is written by Katie Perry, owner of Ursa Major Media, which provides fractional marketing services and strategy in software, tech, consumer products, professional services, and other industries. She is also the co-host of Stocktwits’ Daily Rip Live show.

Disclaimer: The contents here reflect recaps and summaries of pre-reported or published data, news, and trends. I have cited sources and context for the information provided to the best of my ability. The purpose of the newsletter is to inform and educate on larger trends shaping business and culture — this is NOT investment advice. As an investor, you should always do your own research before making any decisions about your money or your portfolio.