- Tuesday Thursday Saturday

- Posts

- ☀️ Best Summer Ever

☀️ Best Summer Ever

Why I Can't Stop Thinking About the Summer of 1998 — Plus, Fresh Data from eToro Signaling What's Top-of-Mind for Retail Investors

Welcome to Tuesday Thursday Saturday! I share a snapshot of trending stories across business, tech, and culture three times a week. Subscribe and tell me what you want to hear about next! - KP

The Big Story: Why 1998 Hit Different

It’s the first 90+ degree day of the summer here in New York, and that has me feeling nostalgic. I’ve always been a summer person. My birthday is in the summer, and as a kid, summers meant hours outside running free in the small rural town I grew up in.

Lately, I’ve been thinking about one specific summer. The summer of ‘98. For some reason, this window of time is so vivid to me, whereas much of my childhood isn’t.

I remember that summer very clearly. I was going to soccer practice three times a week, traveling to other states for tournaments, my diminutive frame wedged in the “way back” of a Volvo station wagon as I was developing intense crushes on most of my older brothers’ friends.

Rear-facing extender seats were the absolute plight of middle children from 1992 to 2002.

I was generally sweaty, tired, and busy — but otherwise, just living life. When I wasn’t at soccer, I was in our above-ground pool practicing “diving” for pool rings approximately 4 feet below the surface. The soundtrack to the summer was whatever was playing on HOT 107.9 — the top pop station in Syracuse — mixed with a soft symphony of bees, distant ice cream trucks, and the low whir of box fans in every room of the house.

It was the kind of summer that now feels both impossibly close and impossibly far. So I started wondering: was it really that simple? Or am I just looking at it through the soft-focus lens of childhood?

I did a little digging. Here’s what was going on in the world during the summer of 1998. Spoiler alert: I was right. It was pretty damn good.

Pop Culture

If you turned on the radio, you were almost guaranteed to hear “The Boy Is Mine” by Brandy and Monica. I had both verses memorized at the time, and I still do.

“Excuse me. Can I please talk to you for a minute?”

Lauryn Hill was on the cusp of releasing The Miseducation of Lauryn Hill (X-Factor, top five song of all time). The Backstreet Boys and *NSYNC were going platinum at a preposterous pace. Early that fall, MTV would debut Total Request Live and dominate early afternoons for a whole generation.

At the movies, Armageddon landed with full bombast in July: Bruce Willis, Liv Tyler, Ben Affleck, and an asteroid. There’s Something About Mary would soon upend the rom-com formula in glorious, chaotic fashion. “Is that … hair gel?”

Network TV still reigned supreme. ER led the Nielsen ratings, with Friends and Frasier close behind. Seinfeld had just ended that May, and people were still debating whether the finale was brilliant or just bewildering. Cable was growing. I was too young for all that, though. Kenan & Kel was IT for me. (Kenan Thompson being one of the most reliable people in my life over the past 25+ years is not something I could see coming.)

The internet was … a novelty. Text messaging hadn’t yet consumed our thumbs, but AIM was inching in. That’s right, I was about to become an emotional terrorist via Comic Sans song lyrics. This behavior would go on for far too long.

The culture was saturated with pop and promise, but also a sort of innocence. The digital deluge hadn’t arrived yet. Everything still felt analog, tactile, slower.

Business

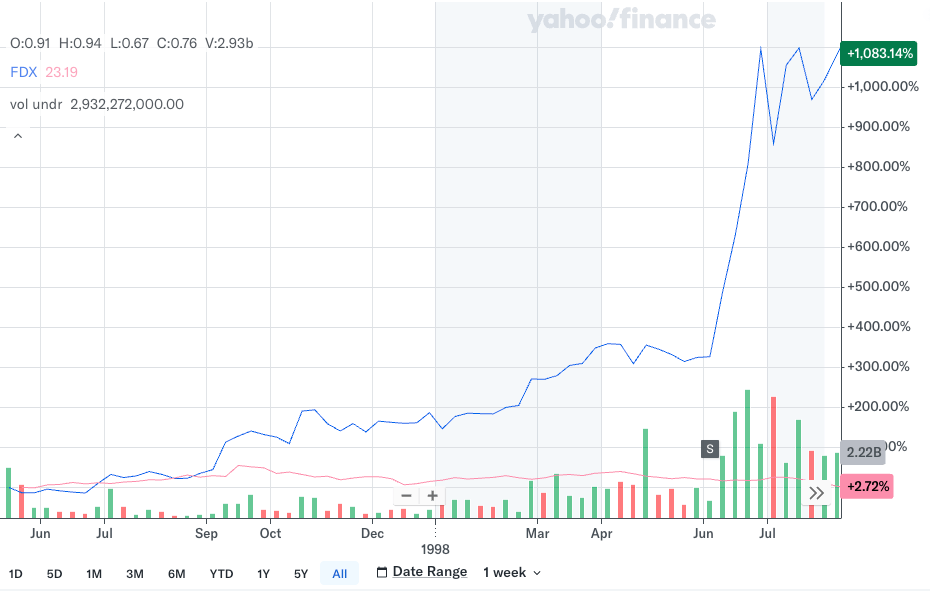

Economically, things were booming. The dot-com bubble was expanding, and optimism was ubiquitous. Amazon was up nearly 970% in 1998. Microsoft, Cisco, Apple, Dell —all of them surging. Everyone seemed to believe in the promise of the internet, even if they couldn’t quite articulate what it was.

AMZN stock chart: Post-1997 IPO through August 1998

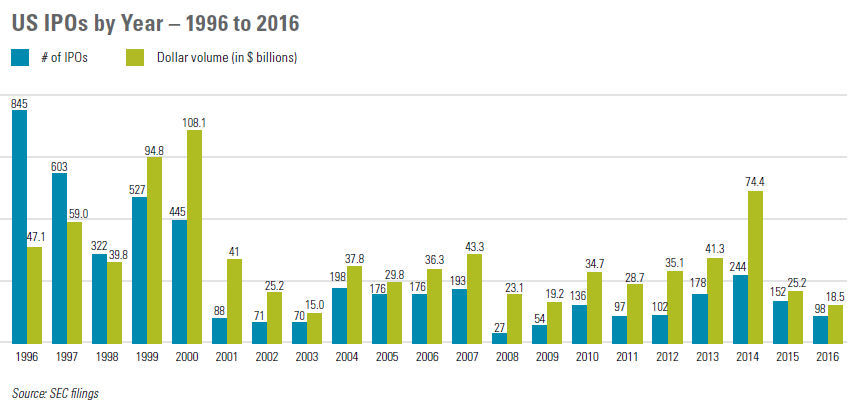

More than 300 companies IPO-ed in 1998, many of them tech or internet-adjacent. Broadcast.com, co-founded by Mark Cuban, went public in July and surged nearly 250% in a single day. By early 1999, Yahoo would acquire it for nearly $6 billion. The exuberance was palpable.

Unemployment hovered around 4.5%. Inflation was low — just 1.6%. Consumer sentiment was high. The economic landscape wasn’t just stable; it felt almost limitless. For many, upward mobility seemed not only possible but inevitable.

World Events

Still, beyond the borders of suburban normalcy, not everything was so simple. There were 27 active armed conflicts around the globe that summer, from the Congo to Kosovo to the Horn of Africa. The Eritrean–Ethiopian War had recently begun. Tensions simmered in the Balkans.

In Russia, a financial crisis was quietly metastasizing. By August, it would devalue the ruble and rattle global markets.

And in the U.S., President Clinton was under intensifying scrutiny. The Lewinsky scandal was escalating. The infamous blue dress had entered the national lexicon. In August, Clinton would admit to the affair, and impeachment proceedings would begin not long after. But for most people, the Clinton scandal felt like background noise. It wasn’t an existential threat to the country. The tone was more tabloid than traumatic.

Looking back, it’s actually insane that a 25-year-old intern bore the brunt of ridicule from this debacle, and not the 52-year-old leader of the free world. But I digress.

Sports

On the field, the Yankees were unstoppable, marching toward a 114-win season and a World Series sweep. MLB had just expanded, adding the Arizona Diamondbacks and Tampa Bay Devil Rays. The Brewers moved to the National League.

Some would say the 1998 Yankees were the greatest team in MLB history.

Globally, France shocked Brazil in the World Cup final, winning 3–0 in front of a home crowd. For a month, the world’s eyes were on soccer.

Eight years later, Zinedine Zidane would famously head-butt Marco Materazzi.

So, was it really that good?

On balance, yes. The numbers back it up. The sentiment supports it. The world was far from perfect, but for many Americans, especially middle-class ones, 1998 was a halcyon stretch.

There was no 9/11. No financial collapse. No smartphone in every pocket. No constant scroll of global suffering. The internet was still a frontier, not a burden. Pop culture was joyful, not algorithmic. Things felt slower. Lighter. Grander, even, in their optimism.

The past tends to feel simpler because we already know how it turned out. But it’s wild to look back at the summer of ’98 and see just how many threads were starting to unravel — or come together. Tech, politics, pop culture, economics: everything was on the verge. And now, looking at where we’ve ended up, you realize that maybe it wasn’t just a childhood thing. Maybe the summer of ’98 really was something.

Daily Rip Live: Secrets, Secrets Are No Fun, Plus — Would You Take $100M to Change Jobs?

Every weekday, my co-host Shay Boloor and I cover the biggest market news and events LIVE on Stocktwits’ morning show, The Daily Rip Live.

Here’s what went down on Wednesday’s show:

⇢ 2:00 | We discussed Sam Altman’s claim that Meta is trying to poach OpenAI employees with $100M offers, sparking a broader debate on Meta’s urgency to dominate AI and justify high CapEx with talent grabs. $META ( ▼ 0.08% )

⇢ 6:33 | Meta reaches nearly 4 billion people globally, which is why they are making moves to improve monetization in WhatsApp, which Morgan Stanley estimates could generate $5B in revenue next year. $MS ( ▲ 0.23% )

⇢ 8:00 | How AI-powered ad platforms from Meta and Amazon could disrupt legacy ad tech players like The Trade Desk, which may struggle as platforms increasingly control the full advertising lifecycle. $TDD ( 0.0% )

⇢ 11:00 | Streaming has officially surpassed cable in U.S. TV viewership, with YouTube capturing a record 12.5% share, shifting ad dynamics further away from traditional players. $GOOG ( ▼ 1.05% )

⇢ 14:45 | Shay revealed a new investment in Archer Aviation, explaining its potential role in “new age defense” and partnership with Anduril to provide software-integrated eVTOL aircraft for military applications. $ACHR ( ▲ 0.74% )

⇢ 22:00 | eToro analyst Bret Kenwell joined to break down new retail investor data, revealing that younger generations are increasingly allocating to both crypto (35%) and gold (38%), viewing both as hedges against a weakening U.S. dollar. $ETOR ( ▲ 20.43% )

⇢ 28:00 | Per Kenwell, a quarter of eToro investors plan to decrease U.S. equity exposure, with growing interest in international markets driven by performance of European equities and a weaker dollar.

⇢ 32:45 | Bret also defended retail investors’ growing sophistication, explaining how many identified AI and emerging tech stocks like Palantir and Robinhood early, benefiting from multi-bagger returns before institutions caught on. $PLTR ( ▲ 1.23% ) $HOOD ( ▼ 0.7% )

⇢ 43:00 | Finally, we discussed CEO Andy Jassy’s memo on job cuts tied to generative AI at Amazon, predicting a shift toward more performance-based contracts, vanishing PTO, and an employer-dominated market. $AMZN ( ▲ 1.19% )

Hope you’ll tune into our next show on Monday at 9 AM EST!

Now Here’s a Chart

Top signal? The so-called SPAC Daddy, Chamath Palihapitiya recently polled X users inquiring if it was time for him to get back into the game, to which the people responded with a convincing “no.”

Palihapitiya has launched over 10 SPACs, taking companies like Virgin Galactic, Opendoor, and Clover Health public, but most have seen significant losses, with an average decline of over 70% from their peaks by 2023. His SPACs initially performed well in the 2020 bull market, but post-2021 market shifts and rising interest rates led to substantial investor losses, with Palihapitiya reportedly earning $750 million while retail investors were left holding the bag.

Whoops.

Reading List

Fed’s Latest Economic Projections Hint at Stagflation Concerns (Investopedia)

Stagflation: Fancy word for when prices keep rising while the economy slows down and jobs are hard to find.

Tesla Faces Calls to Delay Robotaxi Launch. Why the Stock Has a Bigger Issue. (Barron’s) $TSLA ( ▼ 1.63% )

Meanwhile, Waymo Applies for NYC Testing Permit, Sending Uber and Lyft Shares Lower (Bloomberg) $UBER ( ▲ 0.77% ) $LYFT ( ▲ 0.23% )

How high can U.S. debt go before it triggers a financial crisis? (The Conversation)

Texas Instruments pledges 'historic' $60bn US chip investment (BBC) $TXN ( ▼ 0.21% )

Los Angeles Lakers owners sell majority stake in the team at $10 billion valuation (Front Office Sports)

WTF is ‘query fan-out’ in Google’s AI mode? (Digiday) $GOOG ( ▼ 1.05% )

Over 16 billion records leaked in “unimaginable” major data breach – here’s what we know (Tech Radar) $AAPL ( ▲ 3.17% ) $META ( ▼ 0.08% ) $GOOG ( ▼ 1.05% )

The U.S. minted 1,000 new millionaires a day last year, UBS report says (Yahoo! Finance) $UBS ( ▲ 0.79% )

Juneteenth celebrations across the US commemorate the end of slavery (AP News)

🎧 Now playing: “How Deep Is Your Love” - Dru Hill

Tuesday Thursday Saturday is written by Katie Perry, owner of Ursa Major Media, which provides fractional marketing services and strategy in software, tech, consumer products, professional services, and other industries. She is also the co-host of Stocktwits’ Daily Rip Live show.

Disclaimer: The contents here reflect recaps and summaries of pre-reported or published data, news, and trends. I have cited sources and context for the information provided to the best of my ability. The purpose of the newsletter is to inform and educate on larger trends shaping business and culture — this is NOT investment advice. As an investor, you should always do your own research before making any decisions about your money or your portfolio.