- Tuesday Thursday Saturday

- Posts

- 🚨 I'm Writing a Book!

🚨 I'm Writing a Book!

I'm Teaming Up With Wiley on a New Book, Plus — Interviews with Joby Aviation's Chairman and Galaxy Digital CEO Mike Novogratz

Welcome to Tuesday Thursday Saturday! Here, I share a snapshot of trending stories across business, tech, and culture three times a week, plus some updates from the daily financial news show I host. - KP

The Big Story: Things Are Happening

This feels very strange to type out because putting things in written form makes them real in a way that saying them does not. But, I AM WRITING A BOOK.

This newsletter is called Tuesday Thursday Saturday because I try to write these three times a week. I’ve written more than 60 editions so far, and it’s been such a fun extracurricular way for me to explore topics outside of the very straightforward nature of my “day job(s).”

If you’ve been following closely, though, I have missed a couple here and there over the past few weeks. I HATE to break a commitment, but it’s because I’ve been cooking up some other things that are eating into the two hours of the day I have to myself outside of client work, shows, friends, and family.

On July 7, I woke up at 3 a.m. with a 95% there concept of a book. This happens to me a lot — waking up in the night with random ideas — and while it wrecks my sleep cycles, I’ve found that getting up and chronicling my ideas is the only way to retain them. In fact, I write at least a quarter of these newsletters in the middle of the night.

I’ve been doing marketing in various forms since graduating from college. I enjoy it and it’s what I am good at. But what many of you may not know is that I’ve always had a love for journalism. I was editor of my high school paper, was a news editor at Notre Dame’s daily student paper, minored in journalism in college, and even attended summer-long bootcamps at Northwestern’s Medill school. I ended up getting into prominent J-schools like Medill, Newhouse (Syracuse), and others, but ultimately landed at Notre Dame for the vibes. I regret nothing.

Journalism is always where I saw my career going, but I graduated during the financial crisis and had to get realistic. Fast. If you’ve ever been on the wrong side of a $1,200/month Sallie Mae bill (that would be $1,800 today), you know that this is no joke, and doing that on an entry-level reporter salary was not going to work. Marketing paid slightly more, and so that was the path I took. I also don’t regret that.

But still, I’ve always applied what I learned and know about journalism to marketing because they really are two sides of a similar coin. Marketing is about telling stories and connecting with people. With journalism, the end goal is truth-seeking (and, of course, ad sales and subscription growth). With marketing, it’s about building an enduring brand and generating revenue. Money makes the world go round, and stories are a big part of this.

But I digress. The night I woke up with the book idea, I wrote a full proposal including an abstract, an outline, sample topics, and a robust marketing plan. I barely got the document done before it was time to roll on set for my morning Stocktwits show. I fired off an email to an editor at John Wiley & Sons I had crossed paths with years back. Wiley is a top ten publisher in the U.S., and they focus on technical and academic thought leadership. They are also publicly traded. $WLY ( ▲ 2.26% )

The next day, Wiley got back, and we set up some time to talk further in a few days. That meeting went well, and the team told me they would be bringing the proposal to the larger editorial committee for their input. A couple of weeks later, I got the news that they wanted to move forward. Paperwork was finalized a couple of weeks after that. And now, it’s time to do the damn thing!

I will be sharing more about the book in the coming weeks. At a high level, it’s an exploration of how companies are adapting to the new realities of the retail investor boom that has sustained itself since Robinhood took off, Covid and Gamestop brought investing mainstream, crypto accelerated real-time trading behaviors, and AI democratized access to investment information for anyone without a Bloomberg Terminal. A lot has been written about retail investors and meme stocks, but far less has been written about the impact of this on management teams and companies trying to navigate it all.

I feel like I’ve been “researching” this topic since I joined Public as their first head of marketing in 2019 (I was there four and a half years), supported Stakeholder Labs’ work in digital IR tech and consulting services, and talked to more than 50 executives — CEOs, CFOs, IR leads — about the new environment. Stakeholder Labs’ CEO Matt Joanou has been talking about this stuff for YEARS, long before most people. And now, it’s top of mind for everyone. I’ve also learned a ton from my friends Sergio Gramitto Ricci and Christina Sautter, who are two of the most prominent academics exploring these topics from a legal and corporate governance standpoint. Finally, I’d be remiss not to credit Howard Lindzon’s borderline obsession with what he calls the “degenerate economy” as a key point of inspiration.

But, there’s so much more I want to learn and surface in the book. I have a Google Sheets document with about 300 names on it already for people I want to talk to for the book. If you’re reading this, you just might be on it! I am going to be scheduling time with as many people as I can to ensure I am getting perspectives from companies, tech providers, lawmakers, institutions, exchanges, and other important players in the financial ecosystem.

I’ve also created this Google Forms link for people who may want to contribute.

All of this to say, I am very excited and grateful to be working on this. I am going to try to keep up with my usual newsletter cadence, but there may be weeks where it’s one or two editions instead of three for the time being. I’ve enlisted my brilliant little sister, Erica, to help keep me honest and on track.

This entire process is a testament to the importance of surrounding yourself with people who are pushing themselves in their fields and taking risks. I never would have thought to try to make this a reality had it not been for my best friend, Gary He, writing a successful (and multiple award-winning) book, or seeing peers in the industry like Nicole Casperson, Heather and Doug Boneparth, Kyla Scanlon, and others pursuing their own projects. My childhood friend Emily Temple also authored an incredible novel a few years back that was lauded by the literary community.

You can go through life envious of the talents and tenacity of others, or you can embrace those people and find energy and inspiration from their success. Ten times out of ten, I would rather be the least accomplished person in a room with room to grow.

More to come on all this soon!

Daily Rip Live Recap: Interview with Joby Aviation’s Executive Chairman, Tim Cook Kisses the Ring, and More Earnings

Every weekday, my co-host Shay Boloor and I cover the biggest market news and events LIVE on Stocktwits’ morning show, The Daily Rip Live. On Thursday, we had a packed house with Joby Aviation Chairman Paul Sciarra and technical trading expert Evan Medeiros.

Here’s what we covered:

⇢ 2:50 Joby Aviation’s earnings highlights, BLADE (passenger biz) acquisition, DoD contracts & retail investor support — 15-min exclusive Q&A with Chairman Paul Sciarra (who is also a Pinterest co-founder!) $JOBY ( ▲ 0.2% ) $PINS ( ▼ 16.83% ) $BLDE ( ▲ 4.32% )

⇢ 20:12 Joby has both defense and commercial applications, so in that sense, Joby is to Boeing as Lockheed Martin is to Archer. Archer is a similar air mobility player that specializes in defense. $BA ( ▲ 1.51% ) $LMT ( ▲ 2.38% ) $ACHR ( ▲ 0.15% )

⇢ 22:44 Did Tim Cook just give Trump a participation trophy? Apple successfully navigates its way out of tariff drama by committing to produce iPhone glass in the U.S. and hand-delivering a gold plaque to Pennsylvania Avenue. Hey, know your audience? $AAPL ( ▼ 2.27% ) $GLW ( ▲ 1.49% )

⇢ 31:40 Historically, August and February are the two worst months for stock market returns. But what if the August drop just doesn't happen this time around?

⇢ 33:27 My co-host Shay Boloor talks about why trust in management is important to him as a long-term investor. He does NOT hold back!

⇢ 37:30 The team, including Evan Medeiros, explores the psychology of exiting a position and how it’s WAY different for a trader than it is for a thematic investor. Shay (investor) dates to marry, while Evan (trader) doesn’t catch feelings.

⇢ 45:40 Jumia: The Amazon of Africa $JMIA ( ▼ 0.43% )

We’re live every weekday, Monday-Thursday, at 9 AM ET. I am taking a few days off next week for some much-needed R&R, but I will be back in action later this month.

Now Here’s a Chart

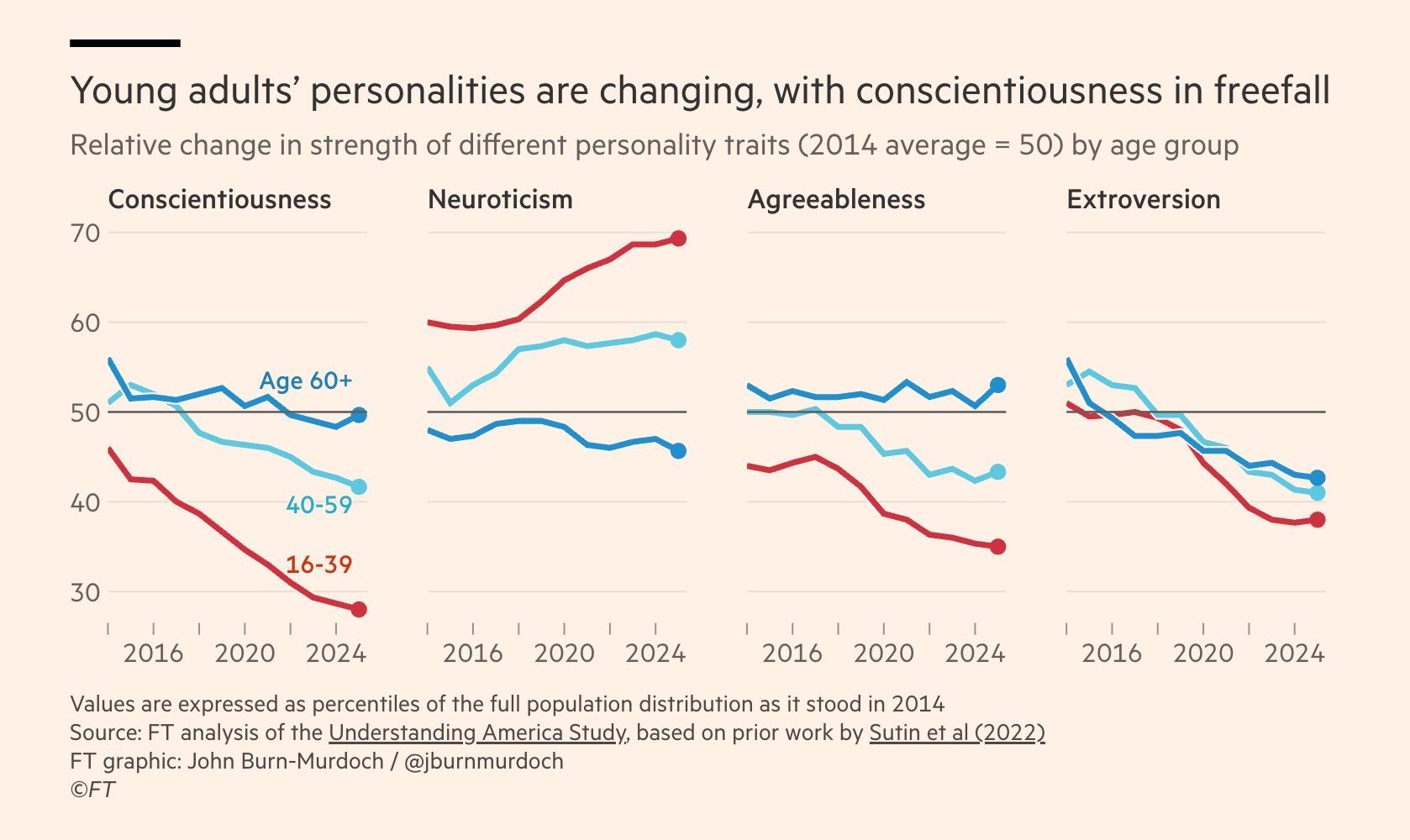

This new data about the changing personalities of Gen Z relative to other generations is alarming people on most corners of the Internet today. Revealed in a Financial Times article, the new research shows that conscientiousness is plummeting among young adults, with neurotism surging.

Reading List

The U.S. economy depends on the rich. That could hurt the labor market (Axios)

What to Know About Trump’s Push for Crypto in 401(k) Plans (Bloomberg) $BTC ( ▲ 5.26% )

See also: My interview with Galaxy Digital CEO Mike Novogratz (Stocktwits) $GLXY ( ▲ 7.49% )

A tariff avalanche catches Switzerland unawares (The Economist)

Intel CEO responds to Trump resignation call with letter to employees (9to5 Mac) $INTC ( ▲ 0.67% )

How Tim Cook convinced Trump to drop made-in-USA iPhone — for now (CNBC) $AAPL ( ▼ 2.27% )

OpenAI's Sam Altman says GPT-5 could 'save a lot of lives,' fuel $100B enterprise AI boom (Fox Business)

Microsoft CEO Satya Nadella had a perfect comeback to dig from Elon Musk (X) $MSFT ( ▼ 0.13% )

Stablecoin issuers like Circle and Tether are gobbling up more Treasuries than most countries (Fortune) $CRCL ( ▲ 6.02% )

Half of Pinterest’s users are Gen Z (CNBC) $PINS ( ▼ 16.83% )

Crocs US sales tumble as shoppers choose trainers (BBC) $CROX ( ▼ 1.61% )

A hot new vibe-coding contender has entered the villa: Anything turns prompts into full-stack apps with backend, auth, and database built in (Neon)

Now Playing: “Bowery” - Zach Bryan with Kings of Leon 🔥🔥🔥

Tuesday Thursday Saturday is written by Katie Perry, owner of Ursa Major Media, which provides fractional marketing services and strategy in software, tech, consumer products, professional services, and other industries. She is also the co-host of Stocktwits’ Daily Rip Live show.

Disclaimer: The contents here reflect recaps and summaries of pre-reported or published data, news, and trends. I have cited sources and context for the information provided to the best of my ability. The purpose of the newsletter is to inform and educate on larger trends shaping business and culture — this is NOT investment advice. As an investor, you should always do your own research before making any decisions about your money or your portfolio.