- Tuesday Thursday Saturday

- Posts

- 💸 Spend Money to Make Money

💸 Spend Money to Make Money

Expensify's Stock is Down More than 90% Since IPO, So Why Is the Company Blowing Millions on an F1 Movie Sponsorship?

Welcome to Tuesday Thursday Saturday! I share a snapshot of trending stories across business, tech, and culture three times a week. Subscribe for more! - KP

The Big Story: Behind Expensify’s Big Swinging F1 Movie Sponsorship

How much would you pay for your logo to be screen-printed onto Brad Pitt’s chest for two and a half hours?

The price tag of Expensify’s title sponsorship of F1® THE MOVIE hasn’t been disclosed, but for a major film like this with such prominent placement, it could easily range anywhere from $5 million to $15 million. Something tells me it’s closer to the upper limit.

We do know that Apple and Jerry Bruckheimer Films reportedly brought in more than $40 million in sponsor product placement for the movie, with Expensify believed to be one of the largest contributors. When Apple first started pitching these deals several years ago, they were asking for eight figures for the best placements, according to one F1 industry executive.

Branded content (think of it as product placement 2.0) is fun, and the streaming era has unlocked new ways for brands to naturally insert themselves into storylines. If you see a certain product featured in a film, like a car, there’s a decent chance that placement was bought and paid for, especially if the film cost a boatload to produce.

While showrunners make strategic decisions around products utilized in their shows, there is a whitespace kept open for sponsored product deals. This is where art and commerce intersect!

The good news is that branded content is a way to authentically associate your product or business organically. The bad news is that branded content can be a black box for advertisers, as it’s nearly impossible to measure. It falls into the “brand marketing” category, as opposed to “performance marketing,” meaning the goal is awareness and consideration rather than immediate conversion.

The point of the sales cycle where you are simply getting on the radar of potential buyers is known as “top of the funnel.” Investing here is crucial for building brands that endure, and for lowering the cost of performance campaigns over time. When everyone already knows and respects your brand, your Facebook ad spend becomes more efficient because the cost you pay per click naturally leads to higher conversion rates and more loyal customers.

Let’s turn back to Expensify. It’s a publicly traded fintech company (Nasdaq: EXFY) that serves small-to-mid-sized businesses, or SMBs. For most B2B companies like Expensify, brand marketing isn’t the top priority. Marketing is typically meant to drive qualified leads to the sales team, who are then tasked with closing deals. Spending is more surgical, focused on narrowly defined personas rather than broad cultural moments.

Things are changing. More B2B brands realize that while they sell to businesses, there’s a human on the other side of every sale. When you market to that human, and not just their job title, your message lands differently. That’s why Salesforce tapped Matthew McConaughey and ServiceNow brought in Idris Elba. And that’s why relatively early-stage startups, including some of my clients — like Agree.com and Subtotal.com — invested in expensive dot-com domains on day one.

“How to Sell a SaaS in 30 Days”

Expensify, however, presents a fascinating case. They IPO’d in late 2021. Since then, the stock has dropped over 90%. It’s one thing for a profitable company with a soaring stock to make a brand splash. It’s another thing entirely for a company with revenue declines and net losses to take a $15 million (estimated!) swing.

This chart would be great if it were representing a downhill ski run.

A founder-slash-investor I know pointed out to me that sometimes you just need to go for it. He brought up the FedEx founder’s infamous blackjack story — the one where he saved the company with a last-ditch Vegas run. That story only gets told because it worked. My previous boss, who also splurged on an expensive dot-com domain, said that marketing is about spending efficiently consistently, but knowing when to take “big swings.” Some will work, and some won’t, and you need to be OK with that.

Let’s run the math behind Expensify’s marketing bet, keeping in mind that I am making several assumptions here.

If Expensify paid $15 million for this sponsorship — the higher end of my estimated range — that would represent more than the total sales and marketing expenses they reported for all of 2024, which was $12.8 million. As a percentage of total revenue, $12.8 million was bout 9.2% of total revenue, which is within a reasonable range for a growth-stage company.

Marketing budget as a percentage of total revenue can vary, and it is often higher than the median for high-growth software/SaaS businesses.

Turning to this year, in Expensify’s Q1 2025 earnings report, they reported spending $3.5 million on sales and marketing in the first three months of 2025, which would indicate that the company made some cuts in some places to keep spending relatively in line year-over-year.

One thing that likely made this more palatable to the CFO (and to shareholders) is that Expensify confirmed it has been paying for the film sponsorship incrementally over several years and will recognize the total in its next earnings report in August. While the exact figure may not be disclosed, investors will see the lift in operating expenses.

Justifying the spend, of course, relies on the return on investment. How many paying and profitable customers will this big swing generate? Customer acquisition cost (CAC) in fintech SaaS for SMBs could range from $200 to $1,000+. For Expensify, a blended CAC around $500 seems reasonable, but again, this is my best guess, and it can vary.

At a $500 CAC, a $15 million investment would need to deliver 30,000 new paying customers to break even. Spread over three years, that’s about 10,000 new accounts per year. For context, Expensify had 687K paying customers in 2024, which was a 4% decline (roughly 28K paying customers) from 2023.

But this isn’t just about net-new customers. Expensify needs to stop the bleeding — AKA not lose 28K customers/year — while growing accounts. A big brand moment like this can drive retention among current users, upsell existing accounts into additional features, and reactivate prospects who’ve lingered in the pipeline for months or years. Marketing doesn’t always bring in strangers; sometimes it’s what nudges the familiar into action.

Expensify CFO Ryan Schaffer said they’re hoping for a 5:1 return on the sponsorship, though a lower return could be acceptable if brand awareness metrics jump. He pointed to a recent example: when actor Damson Idris wore an Expensify APX GP firesuit on the Met Gala red carpet in May, sign-ups spiked 4x for several hours.

Importantly, Vogue Instagram posts, website traffic, and sign-ups do not equal profitable customers. So we’ll have to wait until the next earnings readout to understand the true impact.

In Q1 2025, Expensify reported a 5% drop in paid members year-over-year, alongside another quarterly net loss, although revenue grew QoQ. These results came long after the sponsorship was signed and long before the F1 movie premiered, but they raise the stakes for whether the brand investment can stem the tide.

To amplify the impact, Expensify coordinated the F1 movie launch with a series of global product enhancements: support for 10 languages, thousands of new international bank integrations, multi-currency billing, and wider access to the Expensify Visa Commercial Card. The message is clear: We’re showing up for global users.

For shareholders, this is either a brilliant long play or an expensive distraction.

The bullish case: Expensify has long leaned into splashy marketing moments (see: their 2019 Super Bowl ad with 2 Chainz and Adam Scott). This campaign puts them inside one of the most culturally visible films of the year in a way that strategically aligns with the global expansion efforts. The fictional team is literally called Expensify APX GP, with their name integrated into press conference backdrops and race-day commentary. Sky Sports’ David Croft says the brand out loud during the film’s big action scenes. It’s much more than a quick cameo.

The skeptical case: This is a very bold move from a company with declining fundamentals. Some investors may argue that top-of-funnel brand awareness doesn’t make sense when retention and growth are under pressure. Wouldn’t the money be better spent improving core product experiences or refining the sales funnel?

Herein lies the paradox. And it’s something I talk about with my clients all the time.

With performance marketing, you can be surgical. You can target a controller at a 25-person firm in Minneapolis with a LinkedIn ad that speaks to their exact needs. You can A/B test, optimize, and track CAC down to the penny.

And yet, the ability to do performance marketing so well in digital channels hasn’t killed off brand marketing. Instead, you might argue that it has made it more valuable. Because without a strong brand, your performance campaigns are shouting into the void. If you think throwing $15 million for a movie sponsorship is “burning cash,” wait until you see what happens when you siphon money into Google or Meta without any brand awareness efforts supporting it.

Nike knows this. That’s why they’re doubling down on emotional storytelling and long-term brand equity after years of turning their back on their core marketing strengths in favor of performance media.

But brand takes time to show returns. And most CMOs don’t get time. The CMO role has the highest turnover rate in the C-suite, often less than three years. CMOs are often asked to deliver near-term results from long-term strategies, and they’re frequently the first to blame when it doesn’t happen fast enough.

Turnover is likely more rapid at smaller companies where the investment in the hiring process is not as extensive.

That’s why whoever made the call at Expensify deserves some credit. It’s gutsy. It’s hard to measure. And in marketing, not everything worth doing fits neatly in a spreadsheet.

I’ll be watching Expensify’s Q2 earnings readout later this summer and reporting back on what we learn. Personally, I’m rooting for them. $EXFY ( ▲ 0.78% )

Now Here’s a Chart

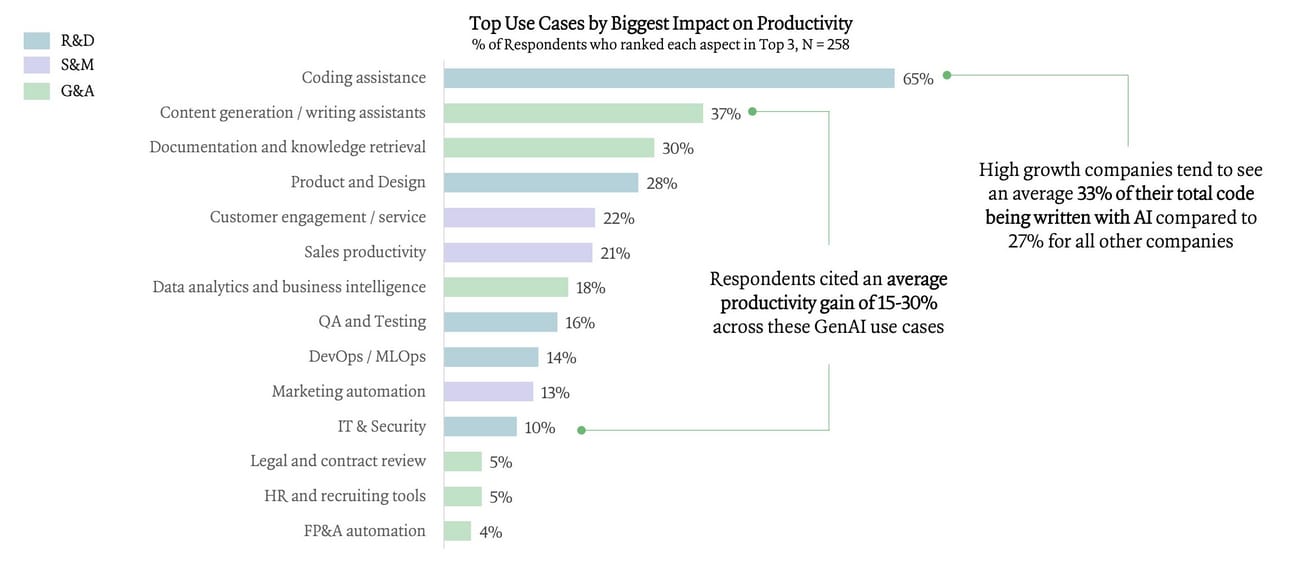

Let’s take a closer look at the adoption of LLMs at the enterprise level, which, according to at least one report, reveals that ChatGPT’s dominance in consumer usage is being mirrored among businesses, as well.

Iconic Capital’s in-depth analysis digs into the nuances behind the numbers: which LLMs are being used for which use-cases, productivity impacts, and more.

Via Deedydas on X, data from Iconic Capital (Full Report)

‘Coding assistance’ was far and away the most common application cited.

Reading List

Why Robinhood is offering tokenized trading (Yahoo! Finance) $HOOD ( ▲ 0.61% )

Judge OKs sale of 23andMe — and its trove of DNA data — to a nonprofit led by its founder (NPR)

Google agrees deal to buy power from planned nuclear fusion plant (FT) $GOOG ( ▲ 3.74% )

Apple Loses Bid to Dismiss Justice Department Antitrust Suit (Bloomberg) $AAPL ( ▲ 1.54% )

Apple is up on news that it’s considering using OpenAI or Anthropic to power its AI assistant (Sherwood Media)

Stablecoin Circle Applies for National Bank Charter (CNBC) $CRCL ( ▲ 1.78% )

Home Depot is buying GMS for about $4.3 billion as retailer chases more home pros (CNBC) $HD ( ▲ 0.97% )

Trading in risky penny stocks is booming. Why it could be a sign of trouble ahead for the market. (MarketWatch)

Now Playing: “July” - Noah Cyrus

Tuesday Thursday Saturday is written by Katie Perry, owner of Ursa Major Media, which provides fractional marketing services and strategy in software, tech, consumer products, professional services, and other industries. She is also the co-host of Stocktwits’ Daily Rip Live show.

Disclaimer: The contents here reflect recaps and summaries of pre-reported or published data, news, and trends. I have cited sources and context for the information provided to the best of my ability. The purpose of the newsletter is to inform and educate on larger trends shaping business and culture — this is NOT investment advice. As an investor, you should always do your own research before making any decisions about your money or your portfolio.