- Tuesday Thursday Saturday

- Posts

- 🌟 What Credible Execs Do Differently

🌟 What Credible Execs Do Differently

Retail investors cite trust as a major factor when it comes to where they put their money. But what makes an executive 'credible?'

Welcome to Tuesday Thursday Saturday! Here, I share a snapshot of trending stories across business, tech, and culture, plus some updates from the daily financial news show I host. - KP

The Big Story: Why Credibility Beats Charisma

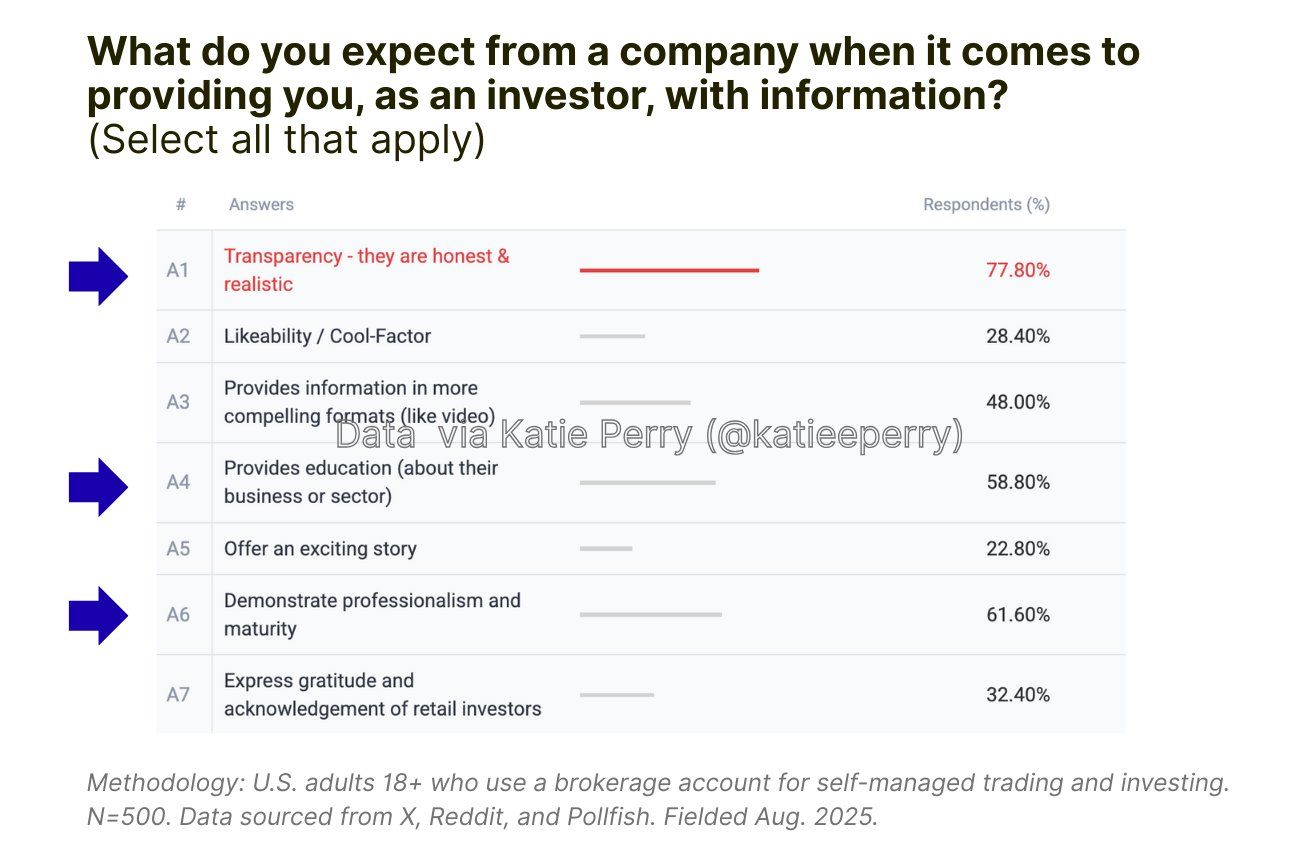

Retail investors, who now hold more power in the market than ever, aren’t just scanning charts and financials when making decisions. They’re looking closely at leadership. In fact, in my recent survey of more than 500 investors, over 80% said the credibility of executives was somewhat or very important in shaping their view of a company.

*Initial survey results, full report to be shared in forthcoming book (Wiley ‘26).

Moreover, “cool factor” is not the first thing investors look for when placing trust in leadership. Their top three: transparency, professionalism, and thought leadership. At the bottom of the list, you’ll find likability and the ability to “tell an exciting story.”

*Initial survey results, full report to be shared in forthcoming book (Wiley ‘26).

Over the past two years, I’ve interviewed more than 50 C-level executives. I’ve been in a lot of rooms and Zooms with leaders hoping to shape a credible, trustworthy narrative. Some are better at it than others. From my experience, credibility is found in the small signals, not the gloss.

Here are several traits I’ve noticed in those who genuinely earn trust.

1. They’re authentic

Not every CEO I talk to is friendly, funny, or charming. That’s fine. Credibility doesn’t hinge on personality type. What matters is whether someone understands who they are, leans into their strengths, and avoids putting on an act.

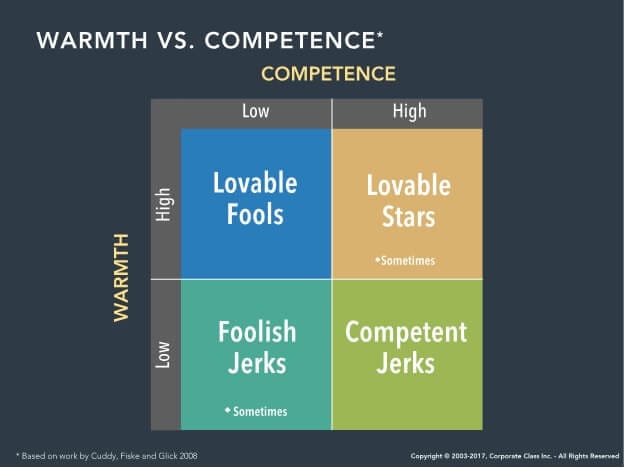

Vanessa Van Edwards, in her book Cues (2022), explains that credibility is built on a balance of warmth and competence. Too much competence without warmth feels cold or arrogant. Too much warmth without competence feels likable but unreliable. The leaders who get it right project both: confidence in their expertise and genuine humanity in how they show up.

2. They connect mission to meaning

Most businesses exist to make money. That’s not unique. What stands out is when leaders connect personally and credibly to why their company matters. A founder who ties the mission to a lived experience or societal need feels believable. But it’s not just about founder stories. I’ve talked with executives who joined later because of their expertise, curiosity about a space, or desire to work with trusted colleagues again. Those are credible reasons. If the only discernible reason is the paycheck, that’s not just a leadership gap but a communications challenge.

3. They show up

Credible executives make themselves available for real conversations. They don’t hide behind canned statements. Long-form dialogue signals confidence in their message and respect for the audience.

4. They are professional

It sounds like the bare minimum, but you’d be surprised how often it’s not. Credible executives are punctual, composed, and respectful. They don’t berate assistants when tech glitches occur or talk down to staff. They create an environment of mutual respect. Professionalism may not be glamorous, but it’s foundational to credibility.

5. They respect the interviewer’s curiosity

Every exec comes into an interview with talking points. That’s expected. But the credible ones also listen to what the interviewer is curious about. They don’t try to hijack the conversation. Forcing every answer back to a script signals a lack of empathy for the story being told to the audience. The best leaders balance getting their points across with engaging the questions in front of them.

6. They educate

The best executives don’t just promote their companies; they teach you something about the industry. It’s not only altruistic. Education demonstrates thought leadership and establishes credibility. It shows they know their space and how to steer the ship in it. Even if some leaders are more operators than visionaries, the best conversations leave me with a better understanding of the industry, framed through the lens of their business.

My friend KT put it well: “I think credibility requires proof of knowledge or ability. But that can get conflated these days.” For example, an influencer who talks through facts can seem less credible than someone who simply flashes a badge, like a title or a degree, without demonstrating real expertise. True credibility is about showing, not telling.

7. They provide context

Numbers without narrative are hollow. Credible leaders attach meaning. These could be simple verbal cues in an explanation. “Here’s why this metric matters for our specific customers…” or “revenue from this segment is up 30% QoQ, well above industry benchmarks…” goes a long way in terms of helping people understand why the data you’re sharing is noteworthy.

8. But also, they use believable numbers

There is no faster way to lose trust than inflated projections or speculative promises. Grounded, reasonable metrics framed honestly go further than exaggeration. The public markets keep most executives honest in this sense. IR teams, CFOs, and CEOs need to keep investors engaged with their stock and excited about growth potential without misleading them. Misleading can have legal implications, and even minor instances can erode credibility and cause investors to mistrust you in the future.

*Initial survey results, full report to be shared in forthcoming book (Wiley ‘26).

This is, of course, less regulated and scrutinized in the private markets. There’s been a lot of reporting on this facet of startup culture, in particular. Building a startup and raising money is about selling a vision, a dream. This involves necessarily painting lofty pictures of how things could be, but this can create a messy grey area. There’s a difference between optimistically, albeit accurately, painting a picture to investors and outright fraud. But sometimes the lines blur.

9. They respect the audience

Clarity without condescension is rare. The most credible leaders assume intelligence but not prior knowledge. This is humility and empathy combined. In my experience, the best leaders explain their businesses and the problems they are solving as if they met an intelligent and curious person in an elevator. You would assume a certain level of understanding, but you would not assume they have years or decades of category or sector experience and know all of the jargon.

10. They’re confident enough to say, “I don’t know.”

This is a big one for me. When a leader admits uncertainty — and explains how they approach finding answers — that speaks volumes. Humility is a credibility amplifier. I recall an interview I did with ServiceNow’s CFO Gina Mastantuono, where she talked about navigating the business through COVID when things felt uncertain. She explained that more important than having the answers in that moment was to clearly communicate to employees how the team was thinking about the problem and getting to the right answers.

11. They’re forthright

Dodging tough questions? Trust erodes fast. Facing them head-on, even with imperfect answers, cements your credibility. Now, a comms expert would have a lot to say about this. There is definitely an art to the “non-answer,” e.g., acknowledge and redirect. This one gets tricky because, as an exec, you don’t want to fall into a trap of misspeaking regarding a sensitive matter. But on the other hand, it’s a bad look to entirely avoid a tough question. The best people in these situations remain calm and collected.

12. They respect their teams (and strangers)

The most credible leaders uplift their teams and share credit. Sometimes the so-called “Glassdoor index” is real: if the team is thriving, odds are the leadership is credible. A commonality among the most credible leaders I’ve talked to is that they are gracious with their compliments to the broader team. They are aware of collective contributions and are confident enough to share the spotlight.

I also pay attention to how someone interacts with producers, staff, or anyone supporting the conversation. How you treat people who can’t “do” anything for you often says more than what you say in an interview.

13. They let you in

The executives who share something personal — not in a performative way but in a human way — build trust faster. It doesn’t have to be dramatic. It can be as small as admitting nerves before earnings calls or sharing how they unwind after a long week. Humanity reads as authenticity.

And then there are the red flags

Some behaviors erode credibility instantly: overexplaining, losing eye contact, condescension. Another is dumping on competitors. There’s a difference between friendly rivalry and disparagement. Harping on rivals can signal insecurity and misplaced energy — unless this is a strategic marketing play where you’re positioning as the challenger brand to a larger, unlikable competitor. Never punch down.

Research also shows that credibility can be misattributed. Sometimes we find people more credible simply because they share our worldview (partisan alignment), or because they project confidence even if their expertise is thin. Meanwhile, true experts may be undervalued because they are less flashy, quieter, or leave room for nuance. It’s a reminder that perception and reality don’t always match when it comes to credibility.

**

At the end of the day, credibility doesn’t only come from charisma or polish; it’s about humility, clarity, and consistent small signals. Especially in an era of overexposure, sharing less but with greater authenticity — or what Forbes calls embracing a “scarcity effect” — can enhance authority and trust.

I was talking last week with Evan Pondel, who teaches communications at USC Annenberg and has worked with hundreds of public company execs in his career. He made a great point: as an executive, you’re never going to please everyone. Analysts, investors, and the press come with their own biases and quirks. But at their core, some credibility factors are universal.

Daily Rip Live: Apple Ups Its Storage, Atlassian Picks Up AI Browser, and VinFast Expands to India and Beyond

Apple expectations, AI browser wars, and Vietnam’s top automaker. We covered it all!

Every weekday, my co-host Shay Boloor and I cover the biggest market news and events LIVE on Stocktwits’ morning show, The Daily Rip Live. Shay has been off getting married for the past couple of weeks, so we’ve had a rotating lineup of amazing guest hosts stopping by!

Yesterday, we welcomed two guests: Amanda Baey, VP of IR at VinFast, a Vietnamese EV maker, and AI/tech investor and analyst Michael Parekh. Here’s what we covered.

Q&A with VinFast Auto

We talked about the EV maker's rapid expansion from Vietnam to other key markets like India, Indonesia, and the Philippines. This is a very interesting company with a unique go-to-market approach relative to other EV players, due to its backing and association with Vietnam's largest private company, Vingroup.

VinFast is the largest automaker by deliveries in Vietnam, recently surpassing Toyota. This goes for EVs and non-EVs. Vietnam is an important emerging market and rising player in the global economy. $VFS ( ▲ 2.81% )

Front-loaded R&D due to conglomerate backing allowed them to launch with a broad range of vehicles (10+), all the way from bikes to SUVs to buses.

Vertically-integrated ecosystem. Vingroup also owns EV taxi fleets and charging stations.

Tech Deep-Dive with Michael

We jumped around to a few topics. Some highlights:

Apple's much-anticipated iPhone 17 event kicks off today, 9/9. No flashy, foldable phones are expected, but Michael says pay close attention to the boring stuff: RAM. | CLIP

Atlassian just picked up The Browser Company for $610M, marking their biggest acquisition since they grabbed Loom for $975M in 2023. The AI browser wars are heating up! Good news for ... Mozilla Firefox?! | CLIP

The market for vibe coding tech continues to expand, with major players like Microsoft doubling down to Anthropic, Lovable, Cursor & Anything picking up steam. Will we see a pure-play vibe coding IPO in the next few years? | CLIP

Reading List

Job growth revised down by 911,000 through March, signaling economy on shakier footing than realized (CNBC)

Rupert Murdoch buys out 3 of his children to seal fate of his media empire (NPR) $FOX ( ▲ 0.33% )

Intel’s chief executive of products departs, among other leadership changes (TechCrunch) $INTC ( ▲ 0.67% )

Starbucks CEO says coffee chain is 'ahead of schedule' in major turnaround effort after one year (Fox Business) - Do we agree? $SBUX ( ▼ 2.44% )

AI tech talent is juicing these real estate markets: SF, NYC, Seattle, Toronto, and DC (CNBC)

Tesla EV Sales Are Struggling But Elon Musk Looks To The Future For Value (Investor’s Business Daily) $TSLA ( ▲ 0.09% )

Anduril Awarded Contract to Redefine the Future of Mixed Reality (Anduril Blog)

‘I’m Gonna Punch You in Your F--king Face,’ says Scott Bessent (Politico)

Tuesday Thursday Saturday is written by Katie Perry, owner of Ursa Major Media, which provides fractional marketing services and strategy in software, tech, consumer products, professional services, and other industries. She is also the co-host of Stocktwits’ Daily Rip Live show.

Disclaimer: The contents here reflect recaps and summaries of pre-reported or published data, news, and trends. I have cited sources and context for the information provided to the best of my ability. The purpose of the newsletter is to inform and educate on larger trends shaping business and culture — this is NOT investment advice. As an investor, you should always do your own research before making any decisions about your money or your portfolio.