- Tuesday Thursday Saturday

- Posts

- 👤 America's Fragile Middle

👤 America's Fragile Middle

Being Middle Class Used to At Least "Feel" Safe. New Data Suggests That's No Longer the Case.

Welcome to Tuesday Thursday Saturday! Here, I share a snapshot of trending stories across business, tech, and culture, plus some updates from the daily financial news show I host. - KP

The Big Story: What the Hell Happened to the American Middle Class?

The stock market is hitting all-time highs. Tariffs have stung, but they haven’t been catastrophic for most people. And yet, some of us can’t shake this sinking feeling that something is … off.

Now, I grew up Catholic, so that impending sense of doom is basically a default setting. But this feels different. I could chalk this up to a millennial-approaching-midlife crisis, where everything about our pre-iPhone childhoods in the 1990s felt less stressful. I was just a kid back then, largely oblivious to the economic struggles of people around me.

Over the weekend, however, I read an article by Katherine Hamilton and Alison Sider in the Wall Street Journal, and it captured something that I’ve been thinking about but haven’t been able to articulate. Being middle class just doesn’t feel as “safe” as it once did.

The WSJ article broadly defines the American middle class as households earning $53,000 to $161,000 a year.

That sense of stability, the idea that if you worked hard you could buy a home, raise a few kids, maybe even go to Disneyland, has given way to something more precarious. Families today feel like they’re running in place, hustling harder, and yet are less confident in their finances. Single people are feeling the heat, too.

The Shrinking Middle

Back in 1971, 61% of Americans lived in middle-class households. By 2023, it was just 51%, according to Pew Research. The decline is subtle, but steady. At the same time, the share of people in lower-income households rose from 27% to 30%, while the share in upper-income households nearly doubled, from 11% to 19%.

One could, of course, view the upper-income jump as progress. In many ways, it is. The data show that more people have moved up. That’s the promise of America after all: fluidity — ideally upwards — between economic classes.

But as any politician with a belly button and who has breathed air would say, “It is the middle class that forms the backbone of America!” Behind the rhetoric, though, the numbers show that this very important group — at least based on the generally vacuous words of our elected officials — is losing headcount and economic clout.

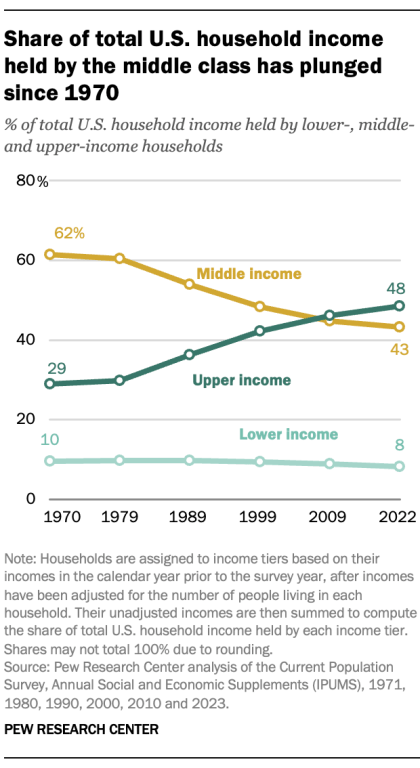

In 1970, middle-class households accounted for 62% of all U.S. household income. Today? Just 43%, according to Pew. That’s not just a “feeling,” as this weekend’s WSJ piece explores. That’s a real redistribution of where dollars are flowing.

Median incomes have risen across the board since 1970, but this has not happened evenly. Middle-class incomes grew about 60% (from ~$66k to ~$106k for a three-person household), while upper-income households rose 78% (from ~$144k to ~$257k). Lower-income households barely gained at all, up just 55%.

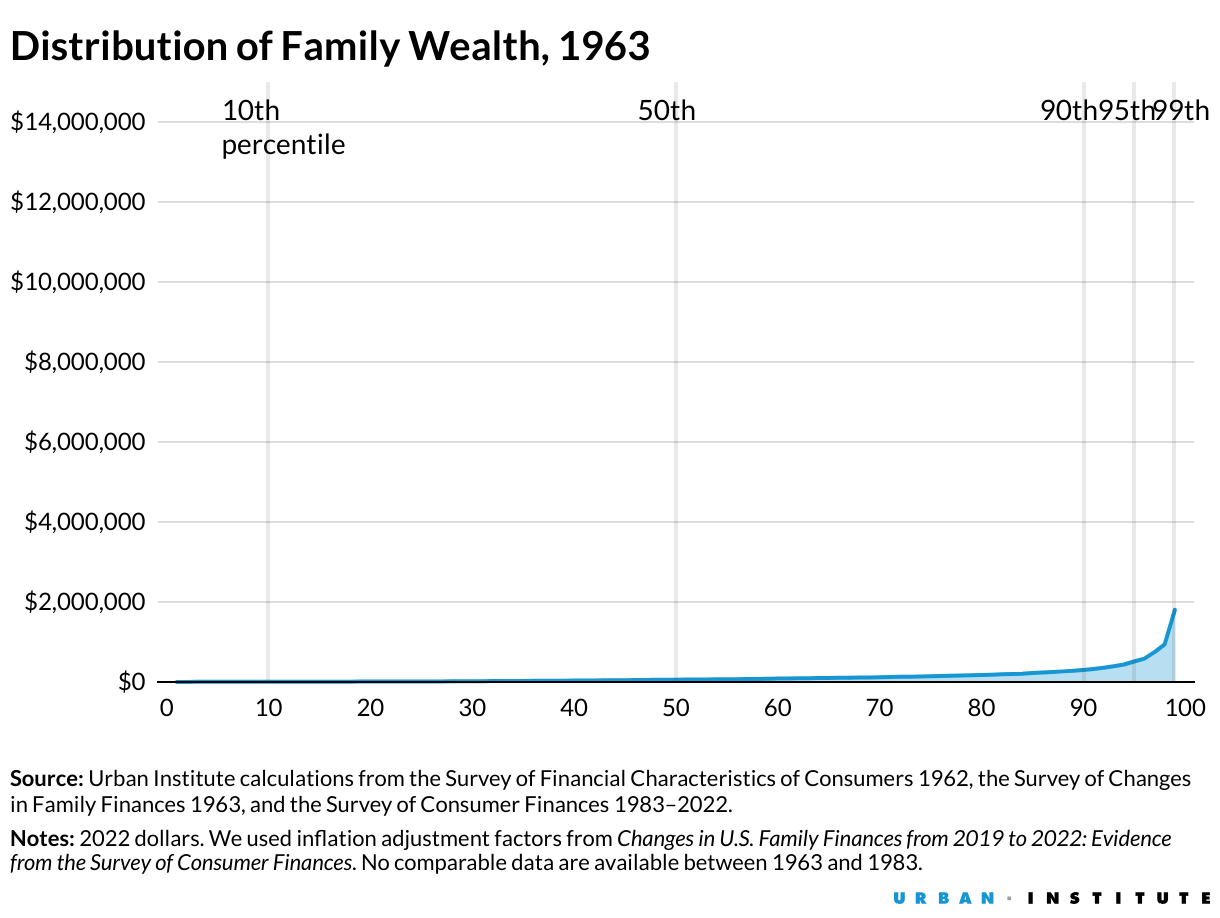

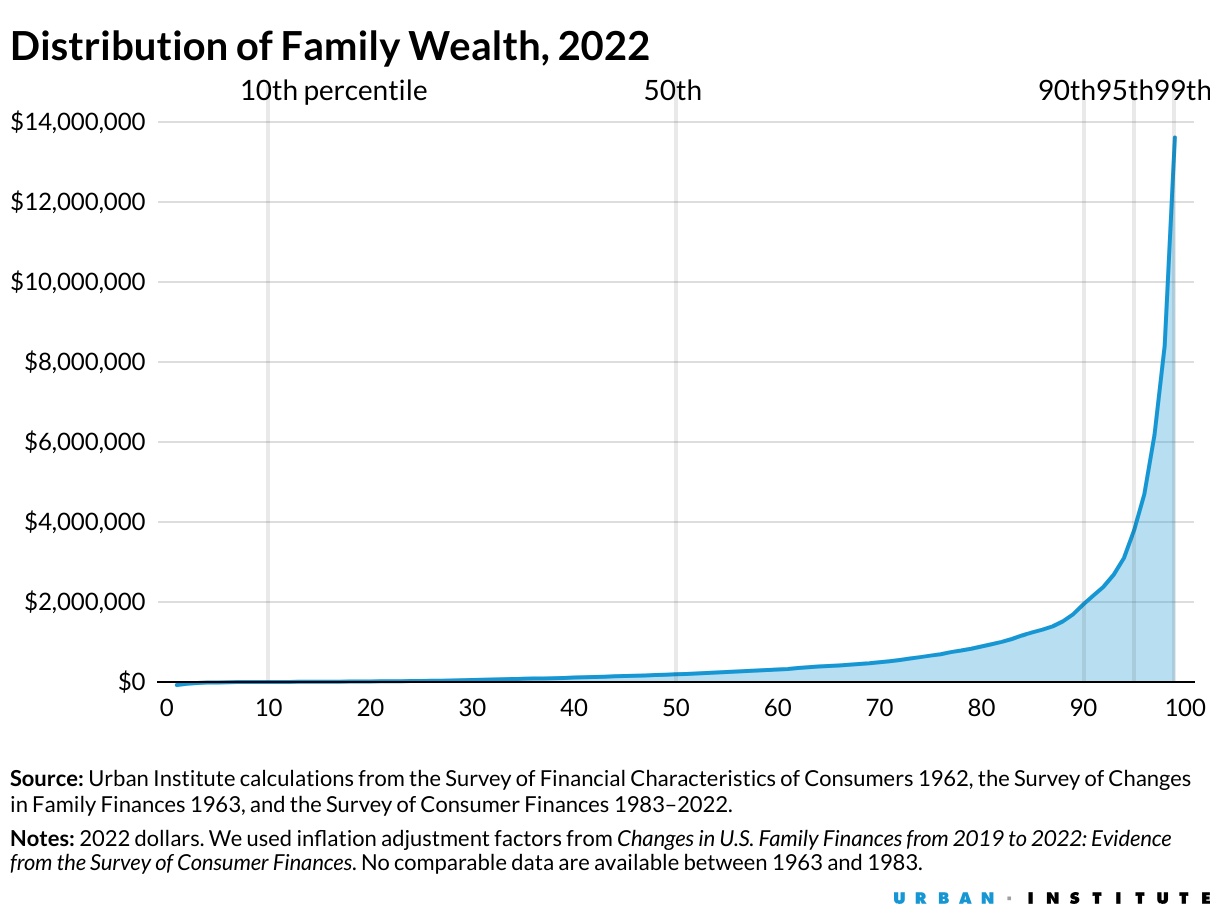

A side-by-side view of wealth distribution from 1963 vs. 2022, via the Urban Institute, makes a similar point, albeit much more visually.

That gap means the middle not only shrank in size; it also fell behind in relative wealth. Costs in housing, education, and healthcare have consistently outpaced wage growth over the years, according to Treasury Department data, putting structural pressure on the middle regardless of raw income numbers.

A July 2025 study from the American Council of Life Insurers found that 55% of middle-class households expressed concern about the risk of a serious decline in their financial situation, signaling persistent vulnerability.

Why It Matters for the Economy

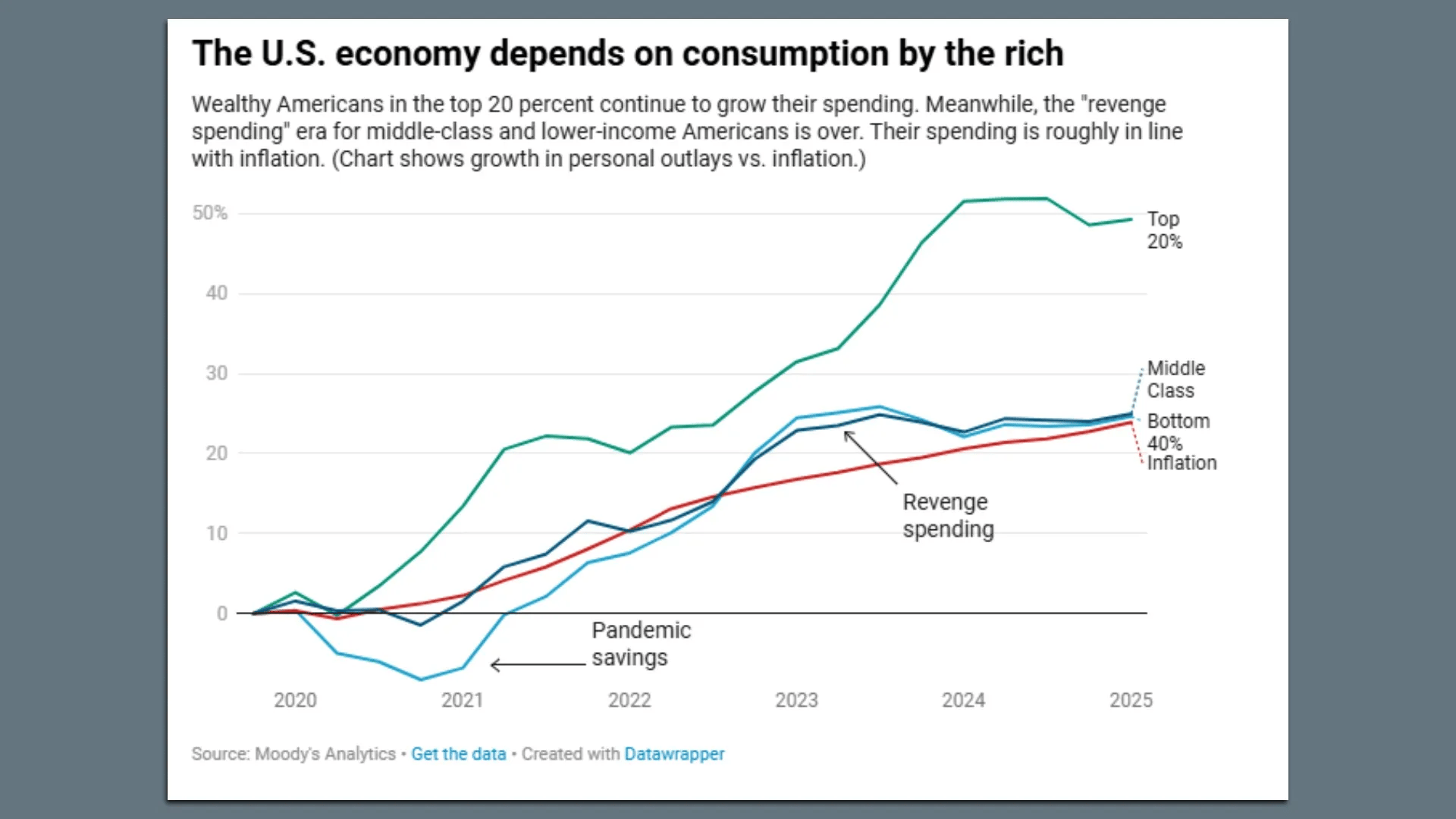

And here’s why it’s everyone's problem: economies run on broad participation. When the majority of people have disposable income, demand is steady and businesses grow. When wealth concentrates at the top, that dynamic shifts.

Yes, the wealthy spend more in absolute dollars, but they save and invest a larger share of their income. Middle-class households, by contrast, tend to spend most of what they earn, fueling local businesses and broader consumption. If that group is thinning or cutting back on spending, the ripple effects hit everything from retail to real estate.

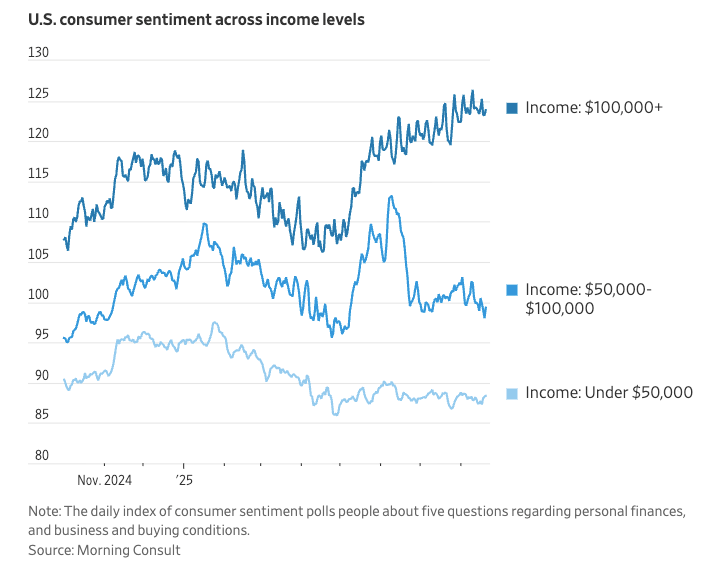

Image via Axios

Some economists say putting too much wealth at the top is like choking off the fuel line. It causes growth to sputter. Add in the fact that the U.S. middle class has historically been a stabilizing political force, and you start to see why so many alarm bells ring when its share slips.

Was It All Inevitable?

Depends on who you ask.

Some analysts argue that the hollowing of the middle class wasn’t just the natural course of capitalism, but the result of policy choices over time. Decisions around tax policy, trade, labor laws, healthcare, and education shaped who benefited most. Critics say those choices often favored capital over labor.

Others point out that globalization, technology, and shifting consumer demand would have reshaped the workforce no matter what, and that policy alone can’t explain the decline.

Most level-headed people can look at the data and agree that things are changing, but we can’t seem to agree on where to place blame. That has only fueled politicians’ absolute obsession with using the middle class as a convenient talking point.

If you’ve ever noticed that every campaign speech, from both parties, somehow includes the phrase “middle class,” this is why. The middle class is both a political identity and an aspirational one. Even people who technically fall into lower- or upper-income brackets often self-identify as “middle class.”

Think about it. It’s such an easy position to take. Talk about fighting for the poor and you risk alienating wealthy people. Defend the rich and you sound elitist. Say you’re protecting the middle class and you’re talking to almost everyone. It’s a political layup.

Celebrating the middle class is important to selling our national narrative. Ah, the American Dream! Work hard, stay honest, and you’ll be rewarded. To acknowledge its fragility is to acknowledge cracks in the national story. (I wrote about these cracks extensively in a July 4th essay, which you can read here.)

What Can Be Done?

Nobody knows? Or at least no one agrees.

Democrats usually argue that rebuilding the middle means higher taxes on the wealthy, stronger labor protections, and more public investment in areas like healthcare, housing, and education. The idea is that government policy can directly relieve financial strain and redistribute some of the gains that have concentrated at the top.

Republicans generally see it differently. They argue that the best way to strengthen the middle is by lowering taxes, cutting red tape for businesses, and creating the conditions for more jobs and wage growth through the private sector. The belief is that growth, not redistribution, is the real engine of prosperity.

So, who’s right? Surprise! The historical record is mixed. In some decades, stronger unions, progressive tax systems, and infrastructure spending aligned with middle-class expansion. In others, periods of deregulation and business-friendly policy also coincided with broad-based growth. Both sides point to their preferred eras as proof, which is why this debate quite literally never ends.

The AI Factor: A New Middle-Class Threat

And then there is an entirely new wrinkle: AI. AI isn’t just automating factory jobs – it’s creeping into white-collar professions once considered immune. That has the potential to gut large swaths of middle-class work. Analysts warn that AI could exacerbate the 80/20 rule: a small share of highly skilled workers and capital holders capture the bulk of the gains, while the broad middle sees diminished opportunity.

There are real upsides to the AI boom: productivity gains, new industries, lower costs —even the first-ever $4 trillion market cap company. But the distributional effect is lopsided. If AI accelerates inequality, the middle class could really be in trouble.

So what now?

The good news is that the middle class isn’t gone. The bad news is that it’s carrying more weight on thinner legs, all with the growing awareness that America’s middle-class dream might be a load of BS. That’s a much larger issue, because when the middle class starts to doubt the system, the system itself can get a little wobbly.

We’re living in a split-screen reality. On one side, more Americans than ever have catapulted into upper-income tiers. On the other hand, many people in the “middle” feel anything but secure. And this isn’t how being in the middle used to feel.

We’ve all heard the speeches and seen the charts about the hollowing middle class. But alongside the numbers is something harder to measure – a fading sense of security for the people living it. And that’s worth paying attention to, whether you’re an investor, a marketer, or simply someone who’s just reading the room.

One more thing: I think it’s important to acknowledge the data-backed racial and gender dimensions to this story. I didn’t dive into them here, but the reality is that “middle class” has never meant the same thing for everyone in America. Those cuts in the data only make the long-term picture even more complex.

Daily Rip Live: We’re Taking The Show on the Road this Week!!!

Every weekday, my co-host Shay Boloor and I cover the biggest market news and events LIVE on Stocktwits’ morning show, The Daily Rip Live.

This week, we’re taking things on the road and will be reporting live each morning from the Gateway Group’s annual Investor Conference! Here’s what you can expect:

We’re filming the show live from the conference on Wednesday and Thursday this week. Same time, same place! 9 AM ET on YouTube, X, LinkedIn, and in your Stocktwits app.

We’re also recording eight executive interviews in the span of 48 hours. I’ll be chatting with CEOs and CFOs from companies spanning AI, FinTech, Cleantech, and other growth sectors. RIP my vocal chords!

By the way, last Friday, I jumped on Ben and Emil’s Weekend Rip Live, and the wheels sort of came off, but that’s the nature of their show, so I’m fine with it. You can watch that here!

Finally, some stories we’ll be tracking during this first trading week of September:

Alibaba earnings: They snuck theirs in the Friday before Labor Day weekend, and the stock was up 19% on cloud unit acceleration and news of a potential new AI chip. $BABA ( ▲ 0.12% )

September slump: Historically, this is the worst month ever for stock market returns. Will we buck the trend in 2025?

New jobs data: The BLS reports August numbers this Friday — an important readout as we near the September FOMC meeting on the 16th and 17th. Prediction markets believe that a rate cut of 25 bps is highly likely, but anything can happen.

Reporting earnings this week: Salesforce, Figma, Asana, DocuSign, Broadcom, American Eagle Outfitters, Lululemon Athletica, and Signet Jewelers (which popped on news of Taylor Swift and Travis Kelce’s impending nuptials). Quite the mixed bag!

Finally, my interview with Surf Air Mobility founder Sudhin Shahani is up on our YouTube channel. $SRFM ( ▼ 5.31% )

Reading List

Alibaba shares jump 19% on cloud unit acceleration, report of new AI chip (CNBC) $BABA ( ▲ 0.12% )

Bessent: Everything on table for housing affordability fixes (Axios)

Nvidia’s top two mystery customers made up 39% of the chipmaker’s Q2 revenue (CNBC) $NVDA ( ▲ 1.02% )

Nestle fires boss after romantic relationship with employee (BBC)

Trump Family Amasses $5 Billion Fortune After Crypto Launch (WSJ)

Soft Skills Matter Now More Than Ever, According to New Research (Harvard Business Review)

Does Cringe Content Work? Why Founders Are Embracing This Unconventional Strategy (Inc.)

Lee Corso’s Farewell Delivers Record ‘College GameDay’ Viewership (Front Office Sports)

🎵 Now Playing: “Blue Moon - Live on KCRW” - Beck

Tuesday Thursday Saturday is written by Katie Perry, owner of Ursa Major Media, which provides fractional marketing services and strategy in software, tech, consumer products, professional services, and other industries. She is also the co-host of Stocktwits’ Daily Rip Live show.

Disclaimer: The contents here reflect recaps and summaries of pre-reported or published data, news, and trends. I have cited sources and context for the information provided to the best of my ability. The purpose of the newsletter is to inform and educate on larger trends shaping business and culture — this is NOT investment advice. As an investor, you should always do your own research before making any decisions about your money or your portfolio.

Thumbnail image of Warren Buffett is AI-generated.